Sometimes, due to unforeseen life events, it can become impossible to pay all your bills. If your house has a tax lien on it, you might want to sell it. However, you may need to use different strategies to sell a house with a tax lien.

If you want to sell distressed property in Florida, consider reaching out to cash home buyers in Tampa, Orlando, Winter Park and Melbourne.

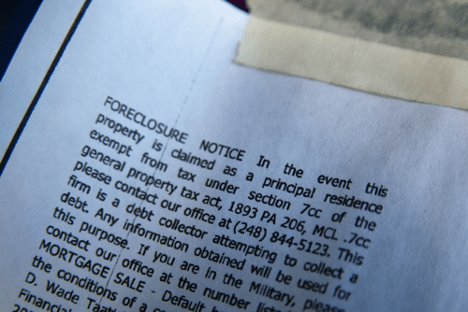

What Is a Tax Lien?

A tax lien is a type of property lien. It means that the filer (in this case, the Florida Revenue Service) gains legal access to your property, and is usually the first step in a foreclosure.

There are several steps before the Florida Revenue Service (FRS) files a lien on your property. If you don’t file a tax return or don’t make a payment, they will send you a Notice of Delinquency.

If you don’t pay on time or don’t pay enough, they will send a bill (a Notice of Amount Due).

And, if you don’t pay your tax bill within 90 days, the FRS will take further actions, including filing a lien. This lien will remain until you either dispute it or pay it off. For many, the only way to come up with enough money is to sell their property.

Types of Property Liens

There are two types of liens in Florida: voluntary and involuntary. Within these categories are several subcategories.

Voluntary liens cover things like mortgages or other agreements that the borrower agreements to voluntarily. These types of liens are common and don’t have much of an effect when selling a house. However, you will probably have to pay off your mortgage before closing.

Involuntary liens are measures taken by the lender when the borrower hasn’t paid their debt. The type of debt determines their category and include:

- Property Tax Liens: Sometimes, your lender will pay your property taxes and add them to your mortgage. If they don’t, the government of Florida can put a lien on your house. Often, this means you will have to sell your home to pay your property taxes.

- IRS Liens: If you owe substantial back taxes, the IRS can place a lien on your property, including your home or car, and force a sale.

- Mechanic’s Liens: If you don’t pay a contractor for work they did on your house, they can file a lien on your home. If their lawsuit is successful, they can force you to sell your house to pay their bill.

- Judgment Liens: If a creditor sues you in court and wins, they can place a lien on your property.

- Child Support Liens: If you don’t pay your child support, your ex-spouse may place a lien on your property. It will remain until you pay or sell your house.

If you are currently facing any of these liens, you might want to consider selling your house or property to avoid foreclosure and a bad credit rating. You can use the profits from the sale to pay off your lien.

Tips For Selling a House With a Lien

Do Your Math

To evaluate offers, you need first to know exactly how much your house is worth. Without an impartial evaluation, you might put your asking price too low or too high, which will affect any offers you get.

Remember that your back taxes should come out of your profit. To complete your sale, you will have to ensure that you pay all your taxes first.

For example, if your mortgage was $120,000, and you have 100,000 left, and $15,000 in back taxes, you’ll have to use the money from the sale to pay the rest of the mortgage and taxes, for a total of $115,000.

Keep Your Own Records

Write down everything. A written record protects you by providing some proof of conversations. After a verbal discussion, send an email confirming any agreements.

Keep a physical file and digital backups of any information regarding your back taxes, mortgage, assessment, or home sale.

Pay Your Tax Lien Before Closing

You can start selling your house with an outstanding tax lien, but you’ll need to pay off the taxes before closing. Use the money from your sale to cover the tax lien.

Research Your Buyers

Make sure your buyers are who they say they are. Confirm their financial records and business information. It’s worth doing this step before getting too far along in the negotiations. You don’t want to waste valuable time with a flaky buyer.

Honesty is the Best Policy

Don’t lie to your buyers about the state of your house. They will eventually learn of any problems, and if that disclosure happens too late, they might back out of the deal. It’s best to lay everything out on the table before the negotiations begin.

Sell To a Cash Home Buyer

Listing with a real estate agent involves a commission fee and could take months. Instead, consider selling your home to an experienced cash home buyer. These companies can offer you money upfront quickly, allowing you to pay off your back taxes sooner.

Why Meli?

If you want to sell a house with a tax lien in central Florida, Meli can walk you through the whole process.

We have worked with many distressed properties and are familiar with the legal requirements and processes that accompany this kind of sale.

Many times, homeowners with tax liens want to sell their property as fast as possible. Meli can help with that.

We offer a quick and straightforward process. Call us at 407-338-4183, or email us at evan@melihomes.com, or reach out using our contact form, and we’ll discuss your home in a free initial consultation. From there, we’ll help you find the best solution for your home. We may make an offer to buy your home with its problems or fix its problems and list it for you. Or, we can simply provide you with additional consultation for a fee.

Call or message Meli today to receive a free initial consultation for your home!

This article is meant for informational purposes only and is not intended to be construed as financial, tax, legal, real estate, insurance, or investment advice. Meli encourages you to reach out to an advisor regarding your own situation. Please consult with your advisor when making legal or financial decisions.

Image Credits

https://pxhere.com/fr/photo/1565509

https://www.pexels.com/photo/file-cabinets-1370294/

https://pixabay.com/photos/money-home-coin-investment-2724248/