When most people think of a distressed home, they tend to think of a run-down home with a poorly kept lawn and broken windows. In reality, there are several additional factors that can make a home distressed, most of which are not readily apparent.

To break it down, there’s a few major categories of problems a house can face that can earn it a “distressed” label. Many of these categories overlap, and some may come hand-in-hand.

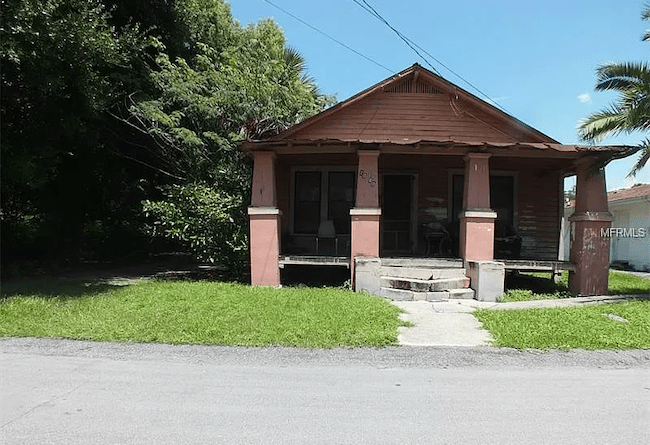

Damaged Homes

The most commonly known distressed housing situation occurs when a home falls into disrepair. This can be due to a number of reasons, including neglect, damage from an accident, natural disasters, or even vandalism. Homeowners may be unable to fix the damages themselves, which can lead the home to being considered distressed.

Luckily, there are homebuyers who look for homes in need of repair. These buyers are often investors looking to buy a damaged home, “flip” it, and sell it for a profit once it’s move-in ready. There are even traditional homebuyers looking to buy a “fixer-upper” and work on their new project home. While it may be tougher to sell a home that’s fallen into disrepair, it isn’t impossible!

Read More:

The Industry of Distressed Homes in Central Florida

Is it Better to Sell a House As-Is or Fix it Up and Then Sell it?

Homes Facing Financial Difficulties

Unfortunately, many homeowners will face financial troubles at some point or another. Many homeowners experience a major financial change in their lives that can cause them to miss mortgage payments, which can lead to the home entering pre-foreclosure, where the lender will begin the process of repossessing it. This is a stressful time for homeowners, and doesn’t leave much time to consider their options. Homeowners in pre-foreclosure DO have some options at their disposal, such as catching up on missed payments, selling the home in pre-foreclosure in a short sale, or selling to an investor.

Another problem many people face when they inherit a home is probate court. Probate is the legal process that occurs after someone dies. It helps ensure that directions in the will (if there is one) are followed. If there is no will, a judge will often have to step in and the probate court will work to value the estate, pay any taxes and debts, and find the best way to fairly distribute the property to any heirs. Probate isn’t always a “problem,” perse, but it can get tricky if the title is murky, there’s no will, or if the beneficiaries can’t post the probate bond or any fees or debts, the home can get “stuck in probate.”

Homes Trapped in Legal Issues

Another problem some homeowners face comes from the local and federal government. Some legal issues are tied in with financial issues, such as probate court. Other legal issues include code violations on the home, which usually incur a fine that accrues interest. If you cannot fix the problem that led to the code violation or pay the fee, you’ll have trouble selling your home to most buyers. Investors like Meli will often work with you to purchase your home if you’re looking to sell without bringing the house up to code, so consider an investor when you are weighing your options.

Heavily tied with a homeowner’s financial problems are tax liens and judgment liens. A tax lien is incurred when you fail to pay your property tax bill. The IRS will send you a “Notice and Demand for Payment,” and if you still fail to pay the bill you may receive a tax lien, which is public record and can drastically harm your credit scores.

A judgment lien usually comes from a legal proceeding in which one party takes another party, the defendant, to court in order to obtain a legal, monetary civil judgment against them. If the defendant is found guilty and can’t pay the damages, a judgment will be filed against them. A judgement creditor is able to seize their property or garnish wages to collect on the judgment depending on the state. If the creditor is aiming to seize property, the homeowners can consider selling their home quickly to an investor or through another quick selling process and pay off the judgment with the resulting funds.

Selling a Home in a Divorce Case

Divorce doesn’t always lead a home to become distressed, but in some divorce cases, the parties may either agree or disagree to sell the home, or just want to get rid of it as fast as possible for emotional or financial reasons.

Many couples who own a property together will attempt to sell their home when they separate in order to divide their assets. This can become difficult if one party doesn’t want to sell the home, but they need to find a way to split their assets. Couples in this situation should speak with their legal advisors before coming to a decision, as the legal issues involved with selling a home during a divorce can be difficult to navigate.

Selling an Inherited Home

Not all inherited homes are distressed, but as discussed during the topic of probate, it can get tricky if a home is entrusted to more than one person, if the title is murky, or if the home has any code violations, liens, or other financial or legal burdens. Dealing with these legal issues can be daunting, especially if the new homeowner is processing the grief of losing a loved one.

The homeowner may live in a different state, or even country, than the home, which can make selling even more difficult. Working with an agent may be the best move in this situation, but if it’s compounded with other issues, it may be best to reach out to a legal advisor or work with an investor who can navigate the legal and financial issues they’re facing.

Read More:

Your Options When You Own Part of an Inherited Home or Divorced Home

Selling a Home Before Relocating

If a homeowner needs to relocate quickly, the home may be considered distressed, as the owner is likely very motivated to sell their home before they have to move. Selling a home typically takes a while, depending on your location, the price you’ve listed it at, your agent (if you have one), and so many other factors, your home could be on the market for as little as a day or could take years to find a buyer. If someone is moving, they likely want to sell it in under a month, if not faster.

Selling through traditional real estate never guarantees a fast sale, so if the homeowner needs to sell their distressed home fast, they can also consider selling to an investor. They won’t make as much as they would through a realtor, but they will be able to sell their home before they move.

Do You Own a Distressed Home?

Owning a distressed home doesn’t mean it’s the end of the world. Most distressed homeowners have options. Take time to learn about your distressed housing situation, consult with a professional if you can, and if you determine that selling to an investor is the right choice, consider reaching out to Meli.

Our team is highly experienced in buying and selling homes, and we work with a partner network of attorneys, realtors, and investors to purchase your home in the shortest time possible. We’re able to buy homes in under 30 days, and can often buy in far less time as needed, depending on the situation. Give us a call at (407) 305-5008 or request an estimate on your home’s value below.

Want to learn more about selling distressed? Get our eBook, “Everything You Need to Know When Selling a Distressed or Difficult-to-Sell Home.”

This article is meant for informational purposes only and is not intended to be construed as financial, tax, legal, real estate, insurance, or investment advice. Meli encourages you to reach out to an advisor regarding your own situation. Please consult with your advisor when making legal or financial decisions.