Selling a distressed property can be intimidating; you want to sell your home fast to avoid a foreclosure. This is especially true when you want to avoid hiring a professional real estate agent. However, there are strategies you can use that can help you sell your home before it is foreclosed on.

Price Your Home Strategically

One of the best ways to sell your distressed property is by pricing it right. Avoid listing your home above its market value if you need to sell it fast. You want to get the best possible price, but you can’t forget you’re working against the clock when you’re selling your home in pre-foreclosure. Even if you do decide to list for your asking price, you will probably have to compromise on your asking price as you get closer to your home’s foreclosure.

Most potential home buyers will hire a well-informed real estate expert to represent them in the home buying process. Their agent can easily find them a better home at a similar price. If you underprice your property below market value, it’s more likely to attract buyers and you’ll be able to sell your property quicker.

Setting an unrealistic price can possibly lead you to losing your home entirely if you can’t find a buyer. It’s important to keep in mind that if your home is foreclosed upon, you won’t receive any compensation and your credit score will likely take a huge hit. It’s likely better for you to sell your home for less than you’d prefer than lose everything to foreclosure.

Plan a Clear Marketing Strategy

Taking time to devise a strategic selling plan with an effective marketing strategy will help you in the long run. Reaching out to a large number of potential buyers on your own is challenging and takes time. You can instead work with a real estate agent who will market your home to a larger pool of potential buyers. Choose a realtor who has strong knowledge of your neighborhood and a robust network of buyers and other agents.

If you want to sell your home on your own, make sure to learn as much as you can about your housing market, analyze the trends, and consider getting assistance from a lawyer. Selling a distressed property on your own is far different from selling a home through a realtor. You can try mailing postcards to neighboring houses to let them know you’re selling to gauge interest.

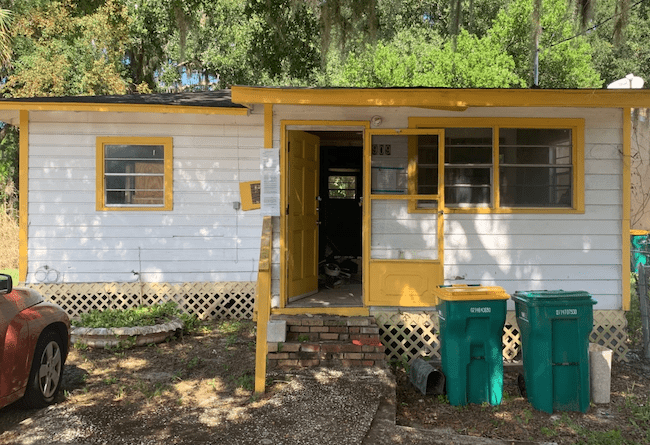

Give your Yard, Kitchen, and Bathroom a Facelift

No one wants to move into a home that requires a lot of work. With that in mind, it’s better to spruce up your home to draw in potential homebuyers. Plan to revamp your home interior, but remember that the outside of your home is the first thing buyers see. Make a good first impression with potential buyers and renovate your home’s exterior.

Improve your home’s curb appeal by cleaning up clutter, manicuring your lawn, installing lighting, setting up a nice patio through home staging, and adding some fresh, green plants. When it comes to the interior, your kitchen and the bathrooms will draw lots of attention.

You don’t need to spend a lot of money renovating your home when you sell distressed. Even a deep clean can do wonders. If you have leaking faucets, broken shower, or clogged pipes, try to fix them and work on cost-effective cosmetic touches. These improvements do not consume much time and transform the entire aesthetics of your home. If an investor is buying your home, they are likely to overlook these problems as they will not be looking to move into your home, and instead will fix it up to sell to a home buyer.

Selling Your Home in Pre-Foreclosure Isn’t Always Easy

Time is of the essence when your home is in pre-foreclosure. The timing can vary, but finding a buyer who is willing to pay you what you want for your home isn’t always possible. There are ways you can manage to sell your home, either by doing it yourself or working with a realtor, but selling through traditional channels takes time, which isn’t a luxury most homes in the foreclosure process have.

Simply put, if you need to sell your property fast with the least hassle possible, it may be in your best interest to sell to a reputable distressed homebuyer. Meli specializes in buying distressed properties, including homes in foreclosure, even if they have other issues tied to them like excessive damage, murky titles, and more.

If you have any additional questions or you’re having trouble selling your distressed home, please get in touch with us using our contact form, or by calling us at (407) 305-5008.

This article is meant for informational purposes only and is not intended to be construed as financial, tax, legal, real estate, insurance, or investment advice. Meli encourages you to reach out to an advisor regarding your own situation. Please consult with your advisor when making legal decisions.